27+ debt income ratio mortgage

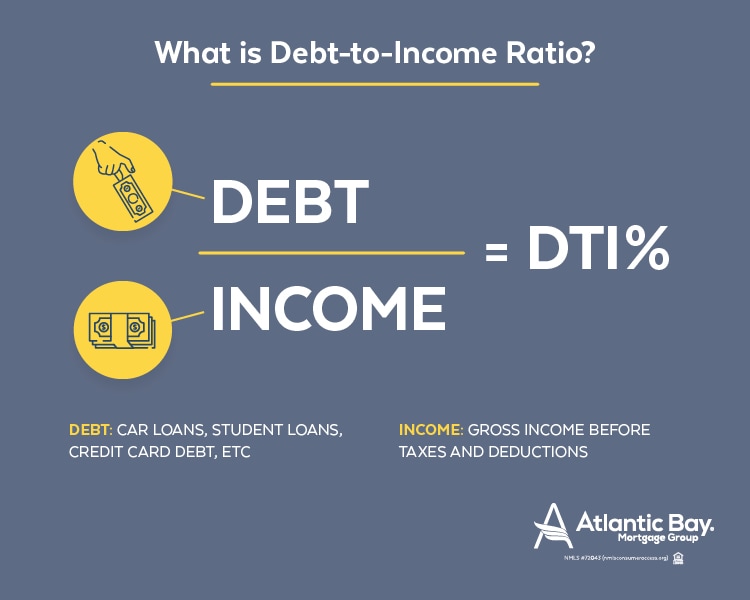

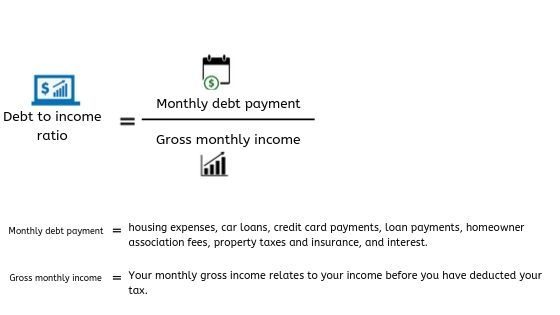

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web A low DTI means you have a good balance between debt and income so a lower percentage increases your chances of approval.

Debt To Income Ratio Crb Kenya

Monthly mortgage or rent payment minimum credit card payments.

. To determine your DTI ratio simply take your total debt figure and divide it by your income. Web Lenders use your debt-to-income DTI ratio to assess whether you can afford the monthly payments on the mortgage youre applying for. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

But with a bi-weekly mortgage you would. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Browse Information at NerdWallet.

Get Instantly Matched With Your Ideal Mortgage Lender. Apply Online Get Pre-Approved Today. Multiply by 100 to get 429 or a DTI ratio of 43.

DTI is a key ingredient in home affordability for many borrowers. The average interest rate for a standard 30-year fixed mortgage is 681 which is a decrease of 16 basis points from one week ago. These payments may include.

Bank We Offer Tools Resources For Navigating Home Loans From Start To Finish. If youre seeking a mortgage use your potential. Ad See how much house you can afford.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Learn More About Mortgage Preapproval. Lock Your Rate Today.

Lenders consider a DTI of 36 as. When a low DTI helps. Multiply that by 100 to get a.

Bank Is One Of The Nations Top Lenders. You may hear your lender use the term front-end ratio This is the ratio of your monthly housing expenses versus your monthly gross. Web The lower your debt-to-income ratio the better mortgage rate youll get.

1 2 For example. If your home is highly energy-efficient. Ad Eased Requirements Make Qualifying For Lower Rates A Snap.

Comparisons Trusted by 55000000. Lock Your Rate Today. According to the FDIC most lenders look for a maximum DTI in the 33.

Web This means if your monthly payment including insurance and property taxes is 100000 and you make 400000 then your front debt to income ratio would be 100000 divided by 400000 which 25. Web This is done by calculating a debt-to-income ratio DTI. Use NerdWallet Reviews To Research Lenders.

Heres how lenders typically view DTI. Ad 10 Best House Loan Lenders Compared Reviewed. Youll usually need a back-end DTI ratio of 43 or less.

Estimate your monthly mortgage payment. Ad Compare Best Mortgage Lenders 2023. Back-End DTI Ratios Two types.

Web Here are debt-to-income requirements by loan type. However there are mitigating factors that allow us to use. Web The 4 ways to lower your Debt-To-Income 1.

Ad 10 Best House Loan Lenders Compared Reviewed. Web Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI ratio of 037 or 37. Comparisons Trusted by 55000000.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web The debt-to-income DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to. Save Real Money Today.

Web 2 days ago30-year fixed-rate mortgages. Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429. For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent.

Web The 28 front-end ratio. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

DTI is calculated the same way as the mortgage-to-income ratio but instead of using only the mortgage expense DTI uses the total sum of all monthly debt payments as we saw in the 36 part of the 2836 rule. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. This number doesnt necessarily portray a detailed picture of your financial strengths and weaknesses but it.

Add up all of your monthly debts. Pay down installment loan balances to lower DTI Installment loans have fix terms and a fixed monthly payment. Web Heres a simple two-step formula for calculating your DTI ratio.

A good general rule is to try to keep this ratio under 42. Take Advantage And Lock In A Great Rate. Ad Eased Requirements Make Qualifying For Lower Rates A Snap.

Business Succession Planning And Exit Strategies For The Closely Held

Kreditbee Blog

Is Family Mortgage Debt Out Of Control Jennifer Nelson

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1939 Session I Department Of Scientific And Industrial Research

Ex99x2 006 Jpg

Why Mortgage Applications Get Rejected What To Do Next

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Business Succession Planning And Exit Strategies For The Closely Held

What S Considered A Good Debt To Income Dti Ratio

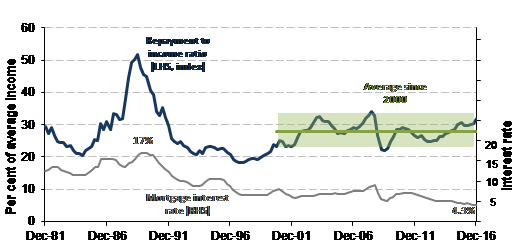

Capping Debt To Income Ratios Complementary To Housing Loan Cap Bank Of Finland Bulletin

Understanding Housing Affordability Openforum Openforum

A111715nareit

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Cara Hopkins O Halloran Real Estate Agent And Owner The O Halloran Group Linkedin

What S Considered A Good Debt To Income Dti Ratio

Debt To Income Ratios Home Tips For Women

Calculating Your Debt To Income Ratio